With Frankness, Vigor, Understanding and Support By Lawrence R. Anderson, Jr. – Attorney at Law

With Frankness, Vigor, Understanding and Support By Lawrence R. Anderson, Jr. – Attorney at Law

On July 13, the Labor Department announced that U.S. inflation hit a new four-decade high of 9.1%, adding that the “consumer-price index’s advance for the 12 months ended in June was the fastest pace since November 1981.”1 Earlier in July, the Federal Reserve “signaled they are likely to raise interest rates by (a) 0.75 percentage point…as part of an aggressive effort to combat high inflation.”2

At a conference in Victor, Idaho, on July 14, Fed governor, Christopher Waller, commented “We knew this inflation report was going to be ugly, and it was. It was just uglier than we thought.” However, “we don’t want to make policy on one data point, and that’s kind of a critical thing.”3 Some economists fear the Fed may raise the rate a full percentage point.

“The Fed hasn’t raised rates by a full percentage point since it began using the federal-funds rate as its primary policy-setting tool in the early 1990s. According to Kansas City President Esther George, “ ‘A rapid pace of rate increase brings about the risk of tightening policy more quickly than the economy and markets can adjust.’ ”4

Factors triggering the predicted interest rate hike, scheduled to be announced at the Fed’s July 26-27 meeting, are varied. “A big jump in gasoline prices—up 11.2% from the previous month and nearly 60% from a year earlier—drove much of the increase, while shelter and food prices were also major contributors…’Inflation makes everything difficult,’ said Lara Rhame, chief U.S. economist for FS Investments. ‘It erodes your savings, your wages, your profits. It’s punishing everybody.’ “5

In spite of the dire news, one small bright spot appeared. U.S. retail sales rose 1% in June. However, behind that silver lining lay another cloud, shrinkflation, “the process of items shrinking in size or quantity, or even sometimes reformulating or reducing quality, while their prices remain the same or increase.”6“Shoppers spent more in June but got less as they weathered the highest inflation in four decades.”7

“Unknown is how long consumer spending can continue growing in the face of inflation. Even though job openings abound and unemployment is historically low, many Americans find their cost of living is rising faster than the income they are bringing home.”8 The Wall Street Journal reports that “some households (are) running scared.”9

This is especially true for households in Louisiana. According to the small business website Merchant Maverick, Louisiana is “number one on the list” of states hit hardest by the current inflation. “Burdened by the highest sales tax rate in the nation (tied with Tennessee) and one of the lowest median household incomes ($51,707, the lowest in the nation after Mississippi), the Bayou State has suffered dearly under the current inflationary economic circumstances.”10

“ ‘To make matters even worse for Louisiana, the US South has seen some of the steepest price hikes nationwide,’ according to the report. ‘Transportation costs in the region rose 20.6% in the 12 months ending April 2022 compared to the previous year. Housing costs rose 7% — more than any other region in the US (with the exception of Maryland and Delaware, where housing also rose 7%).’ ”11

The news about our personal and national financial future seems grim. In keeping with our series format, I will again look at how our country, and increasingly our government, dealt with financial situations even more formidable than ours.

Our last article focused on the cycles of economic “boom and bust” in our country, which began in the early 1800s. Initiated by the “Era of Good Feelings” which was personified by General Andrew Jackson, later President, and his victory at the Battle of New Orleans in 1815, our country’s rapid expansion fueled speculation and outpaced economic stability.

The desire for a better life exposed fundamental differences between East and West and North and South, so deeply fragmenting our country that it led to the Civil War. The aftermath of the Reconstruction and the subsequent Panics of the late 1800s revealed the striking need for debt relief for businesses and individuals alike.

The first long-lasting bankruptcy act was created in 1898 by Congress, primarily to rescue the railroad industry, which was our nation’s first large corporate entity. “The chief advocates for it were merchants and manufacturers who provided trade credit to retailers throughout the country. The merchants and manufacturers wanted a bankruptcy law to deal with the everyday problems of growing interstate commerce.”12

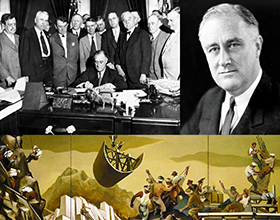

During the Great Depression in the 1930s, the 1898 Act was amended. Under President Franklin Roosevelt, “New Deal reforms to corporate bankruptcy sidelined elite lawyers and strengthened the lawyers who represented small business and personal bankrupts. This latter group joined with pro-debtor interests in resisting the demands of consumer creditors to force personal bankrupts into repayment.” 13

“Many of its most important provisions had been drafted by William Douglas, who was appointed to the United States Supreme Court by President Roosevelt shortly thereafter, and went on to serve longer than any other justice in history. (William Brennan described Douglas as one of the two geniuses he had known in his life.) Douglas had worked on the project with a variety of other prominent New Deal reformers. In its own time, Douglas’s handiwork had itself been seen as a milestone in progressive, up-to-date legislation for resolving the age-old problem of financial distress…Congress amended and expanded its 1898 Bankruptcy Act many times but did not replace it until 1978.”14

Over the last forty-four years, American bankruptcy law has evolved into an acceptable, legitimate option for individuals and businesses facing overwhelming debt. Although the stigma has dramatically diminished, filing bankruptcy should always be a last resort. We are fortunate to live in a country that allows fresh starts and new beginnings to those who find themselves in financial distress.

As I complete this blog series on the development of debt relief in our country, many of us are feeling understandably anxious anticipating the Fed’s rate hike next week. Rather than worry, be proactive. Recall how individuals, businesses, and corporations have persevered through similar tough times with courage and hope.

In his first inaugural address in 1933, President Franklin Roosevelt exhorted people in all walks of life to take heart during the Great Depression’s darkest time. “This great Nation will endure as it has endured, will revive and will prosper. So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself—nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance. In every dark hour of our national life a leadership of frankness and vigor has met with that understanding and support of the people themselves which is essential to victory. I am convinced that you will again give that support to leadership in these critical days.”15

I am ending this post with practical advice on how you can get your personal, family, and business house in order. These suggestions, taken from the same excellent online article by Equifax, focus on career choices, emergency funds, and staying on top of your financial situation.

NOTE: The following article has been updated by Equifax – new title and text. Because we have already begun our series, we will take up in the new article where we left off in the old. The information is basically the same, only more directly tied to our current economic situation.

Prepare for a Recession

(Accessed July 19, 2022) in Equifax. https://bit.ly/3yEeQE9

Excerpt, Way #3

CONSIDER YOUR CAREER OPPORTUNITIES, BOTH NOW AND IN THE FUTURE

Recessions often result in high levels of unemployment. So, it’s important to consider how tough economic times could affect your career and have a backup plan should you face a layoff.

Start by refreshing connections within your professional network. Be sure to consider not only your coworkers but also any connections you have outside of your current employer. Having established relationships at a variety of organizations can give you a huge leg up in the job market. You might consider reaching out to your network via social media or offering to meet up in person for coffee.

It may also help to update your resume and other job-hunting tools ahead of time. As you review your past work experience, look for any gaps. Are there places where you could pursue continuing education or additional training? Expanding your skill set is one of the best ways to invest in yourself as an employee. This is true even if you’re able to keep your position during a recession.

For some workers worried about a layoff, it may be beneficial to pick up a side gig such as freelancing or working for a rideshare application. Having an extra stream of income can not only help in the event of a layoff but can make it easier to build your emergency savings while you’re still employed.

TRY TO BOLSTER YOUR EMERGENCY FUND AHEAD OF TIME.

Even if job cuts or layoffs are looming, put as much cash into your emergency fund as possible. You’ll need every bit of it when the income stops flowing. Give up all the extras, including takeout and delivery.

While tapping into your emergency

fund is never a decision you should make lightly, losing a job or being forced to live on a reduced salary certainly qualifies as a good reason to use some of the cash you’ve put away. However, it’s important to rebuild your emergency fund as soon as your financial situation is more stable. Otherwise, when the next emergency hits, you might have to make tough decisions, like withdrawing money from your retirement account or applying for a home equity line of credit.

MAKE AN EFFORT TO STAY ON TOP OF YOUR FINANCIAL SITUATION

A recession may be an uncertain time, but the best thing you can do is take proactive steps now to prepare yourself. To help you stay on top of your finances in these stressful times, you can trust Equifax for reliable information on need-to-know topics. Now more than ever, financial education is important, so you can feel good about where you are with your money, regardless of any challenges ahead.16

Next week we will take a break from writing. We will be preparing new series which answer questions you have, tailored to our economy’s current situation. We will resume Thursday, September 1.

Meanwhile, I wish you and your family continued success on safeguarding your family and business finances.

###

If you would like more information about how I can help you protect your family or business assets, please call (225) 324-7459 or email [email protected]

1 U.S. Inflation Hits New Four-Decade High of 9.1%: Prices up broadly across the economy, with gasoline far outpacing other categories By Gabriel T. Rubin Updated July 13, 2022 7:07 pm ET (Accessed July 15, 2022) https://www.wsj.com/articles/us-inflation-june-2022-consumer-price-index-11657664129.

2 Fed Officials Preparing to Lift Interest Rates by Another 0.75 Percentage Point: Policy makers are leaning against full-point increase despite June inflation surge By Nick Timiraos July 17, 2022 10:30 am ET (Accessed July 17, 2022) https://www.wsj.com/articles/fed-officials-preparing-to-lift-interest-rates-by-another-0-75-percentage-point-11658068201?mod=hp_lead_pos1

3 Ibid.

4 Ibid.

5 U.S. Inflation Hits New Four-Decade High of 9.1%: Prices up broadly across the economy, with gasoline far outpacing other categories By Gabriel T. Rubin (Accessed July 15, 2022)

6 Shrinkflation From Wikipedia, the free encyclopedia (Accessed July 17) https://en.wikipedia.org/wiki/Shrinkflation

7 U.S. Retail Sales Rose 1% in June: Consumers spent more across a range of goods while inflation reached new four-decade high By Sarah Chaney Cambon and Rina Torchinsky Updated July 15, 2022 12:08 pm ET https://www.wsj.com/articles/retail-sales-june-rose-consumers-inflation-11657833254?mod=hp_lead_pos1&mod=hp_lead_pos2

8 Ibid.

9 People Have Money but Feel Glum—What Does That Mean for the Economy? By Jon Hilsenrath and Rachel Wolfe July 14, 2022 10:16 am ET 1. https://www.wsj.com/articles/people-have-money-but-feel-glumwhat-does-that-mean-for-economy-11657808195

10 Report: Louisiana tops list as state most impacted by recent inflation By Victor Skinner The Center Square contributor Jul 6, 2022 b. https://www.thecentersquare.com/louisiana/report-louisiana-tops-list-as-state-most-impacted-by-recent-inflation/article_fb38cb50-fd46-11ec-931b-87a10ddd39ed.html

11 Ibid.

12 Hansen, Mary Eschelbach; Hansen, Bradley A.. Bankrupt in America (Markets and Governments in Economic History) (pp. 7-9). University of Chicago Press. Kindle Edition

13 Ibid.

14 Ibid.

15 “Only Thing We Have to Fear Is Fear Itself”: FDR’s First Inaugural Address. History Matters, The U.S. Survey Course on the Web (Accessed July 19, 2022) http://historymatters.gmu.edu/d/5057/

16 5 Ways to Prepare for a Recession (Accessed July 19, 2022) in Equifax. https://bit.ly/3yEeQE9